The Permanent Account Number (PAN), which is a unique 10-character alpha-numeric number, is mandatory to be quoted for filing of income tax returns (ITRs). All your financial transactions can only be processed if you have a PAN. All bank accounts and the Aadhaar identity card of an individual must be linked with PAN. PAN helps the tax department keep a tab on all your financial transactions and also helps it nab tax evaders.

In a recent order, the government has made it mandatory to link Aadhaar - a 12-digit unique identity number given by the Unique Identification Authority of India - with the PAN card by December 31. However, if the details of both the IDs do not match, one has to update his PAN card and furnish his name, address, date of birth etc as is mentioned in the Aadhaar ID. https://www.ndtv.com/business/aadhaar-card-linking-three-aadhaar-linking-deadlines-not-to-miss-1761225

How to update PAN card details

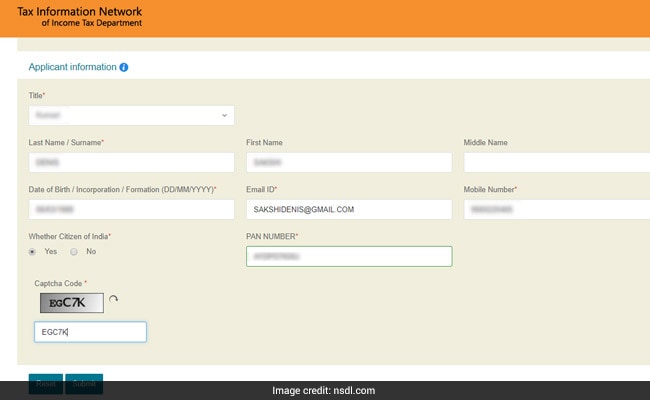

Go to the website of NSDL

Applicants should fill PAN change request form online and submit it. The same form will be applicable for citizens as well as non-citizens of India, according to NSDL's website.

(Applicants should fill PAN change request form online and submit it.)

They can initially select PAN change request along with citizenship, category and his/her title and then enter the required details and submit the form. A token number will be generated and displayed to the applicant before filling the form. This token number would also be sent on email Id (provided in the application) for reference purpose.

Users can select any one of the following four options while filling PAN change request application online:

1. Physical acknowledgement

The applicant has to print the successfully generated application form, affix recent colour photographs, duly sign in the space provided, and forward the same alongwith prescribed supporting documents to NSDL's official address given on its website.

2. Digital Signature Certificate (DSC)

In DSC option, the applicant needs to upload scanned images (as per defined parameters) of photo, signature and supporting documents while making the application. There is no need to send PAN application form and supporting documents to NSDL.

3. Aadhaar based e-Sign

Under this option, the applicant needs to upload scanned images (as per defined parameters) of photo, signature and supporting documents while making his application. Aadhaar would be considered as supporting document. There is no need to send the PAN application form and supporting documents to NSDL.

4. Aadhaar based e-KYC

In Aadhaar based e-KYC option, Aadhaar details would be considered as PAN application details (name, date of birth, gender, residential address, email ID, mobile number & photograph) and Aadhaar as supporting document and would be forwarded to the Income Tax Department for allotment of PAN. All these fields are non-editable.

The photograph used in Aadhaar would be used in PAN card and there is no need to upload a supporting document, photo and signature. PAN card will be dispatched at the address mentioned in Aadhaar.

However, if the data submitted fails in any format level validation, a response indicating the error(s) will be displayed on the screen. The applicant should rectify the errors and re-submit the form.

If there are no format level errors, a confirmation screen with data filled by the applicant will be displayed. The applicant may either edit or confirm the same.

For changes or correction in PAN data, fill all mandatory fields (marked with *) of the form and select the corresponding box on the left margin of appropriate fields where correction is required.

If the application is for re-issuance of a PAN card without any changes in PAN related data of the applicant, fill all fields in the form but do not select any box on left margin.

In case of either a request for change or correction in PAN data or request for re-issuance of a PAN card without any changes in PAN data, the address for communication will be updated in the income tax department's database using address for communication provided in the application.

How to cancel PAN card

For cancellation of PAN, fill all mandatory fields in the form, enter PAN to be cancelled in item No.10 of the Form and select the check box on left margin. PAN to be cancelled should not be same as PAN (the one currently used) mentioned at the top of the Form.

How to make payment for PAN card

If communication address is within India, the fee for processing PAN application is 110.00 ( Rs. 93.00 + 18.00% Goods and Services Tax). If communication address is outside India, then the fee for processing PAN application is Rs. 1020.00[ (application fee Rs. 93.00 + dispatch charges Rs. 771.00) + 18.00% Goods and Services Tax].

Payment can be made either by demand draft, credit card / debit card or net banking.

No comments:

Post a Comment