Almost two lakh security personnel manning ATMs across the country may lose their jobs over the next two-three years as Indian banks have started deploying advanced e-surveillance architecture for security and monitoring of their cash machines.

Axis BankBSE -9.52 % has taken a lead in implementing the globally prevalent centralised e-surveillance in most of its ATMs while others such as State Bank of IndiaBSE -2.77 %, HDFC Bank and Uco Bank are in the various stages of mechanising their ATM security arrangement.

Bankers say the shift will help them save up to 90% in security costs and that the modern system is safer and more reliable. "This (centralised e-surveillance) enables us to remotely monitor our ATMs 24x7 rather than relying on the guard to report any incidents," said a senior official from HDFC Bank, which is running a pilot in 500 machines. He said the bank will do additional deployment going ahead.

"The security guards and policemen who are deployed today to physically monitor infrastructure and establishments could be redeployed for active security work," said Pande.

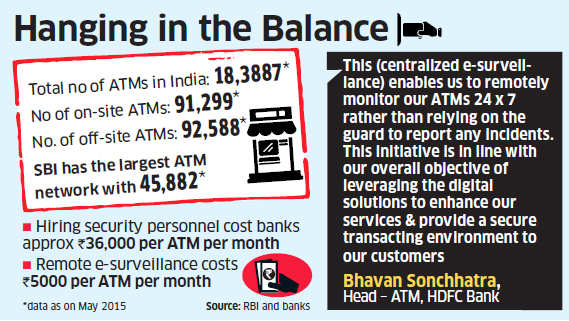

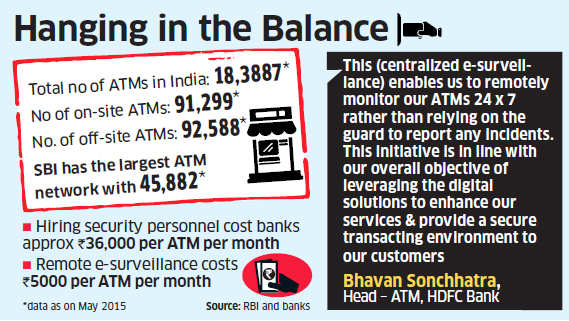

Indian banks have installed about 1.84 lakh ATMs between them as of May end. One-fourth of them belong .to SBI

Axis BankBSE -9.52 % has taken a lead in implementing the globally prevalent centralised e-surveillance in most of its ATMs while others such as State Bank of IndiaBSE -2.77 %, HDFC Bank and Uco Bank are in the various stages of mechanising their ATM security arrangement.

Bankers say the shift will help them save up to 90% in security costs and that the modern system is safer and more reliable. "This (centralised e-surveillance) enables us to remotely monitor our ATMs 24x7 rather than relying on the guard to report any incidents," said a senior official from HDFC Bank, which is running a pilot in 500 machines. He said the bank will do additional deployment going ahead.

This initiative is in line with our overall objective of leveraging the digital solutions to enhance our services & provide a secure transacting environment to our customers," Sonchhatra said.

A centralised e-surveillance facility can monitor ATMs 24x7 from a security operation centre.

A centralised e-surveillance facility can monitor ATMs 24x7 from a security operation centre.

The system includes installation of multiple sensors—motion sensor, thermal sensor, removal sensor and breaking sensor—a hooter or alarm, 2-3 CCTVs, and a two-way speaker in the ATM room. In the event of unauthorised activities, a hooter alert propels a twoway communication between the officials at the security operation centre and the alleged intruders, through mike, speakers and CCTV system. The system would also alert the local police station and nearby onroad patrolling officer.

Banks are also deploying a quick response team to visit ATMs whenever the need arises.

"The e-surveillance solution is safer and more reliable than physical caretaker," said Rajiv Anand, head for retail banking at Axis Bank.He also pointed out that the cost of e-surveillance is approximately Rs 5,000 per site per month while at present banks spend about RsRs36,000 per ATM per month for engaging security guards in three shifts a day.

Uco Bank Executive Director JK Garg said that the bank is planning to put a centralised surveillance system in place to reduce cost. According to Bank Employees Federation, as many as 20,000 contractual security personnel guarding ATMs may turn redundant immediately. About 370 people have lost jobs this year in West Bengal alone. Kunal Pande, partner at KPMG in India, said most banks in the country so far merely brought ATMs under CCTV coverage. "Although this can greatly add to efficiencies of security and law enforcement agencies and reduce reliance on physical security guards, they can only help in monitoring, they cannot provide an immediate response to a crime in action," he said.

Banks are also deploying a quick response team to visit ATMs whenever the need arises.

"The e-surveillance solution is safer and more reliable than physical caretaker," said Rajiv Anand, head for retail banking at Axis Bank.He also pointed out that the cost of e-surveillance is approximately Rs 5,000 per site per month while at present banks spend about RsRs36,000 per ATM per month for engaging security guards in three shifts a day.

Uco Bank Executive Director JK Garg said that the bank is planning to put a centralised surveillance system in place to reduce cost. According to Bank Employees Federation, as many as 20,000 contractual security personnel guarding ATMs may turn redundant immediately. About 370 people have lost jobs this year in West Bengal alone. Kunal Pande, partner at KPMG in India, said most banks in the country so far merely brought ATMs under CCTV coverage. "Although this can greatly add to efficiencies of security and law enforcement agencies and reduce reliance on physical security guards, they can only help in monitoring, they cannot provide an immediate response to a crime in action," he said.

"The security guards and policemen who are deployed today to physically monitor infrastructure and establishments could be redeployed for active security work," said Pande.

Indian banks have installed about 1.84 lakh ATMs between them as of May end. One-fourth of them belong .to SBI

No comments:

Post a Comment