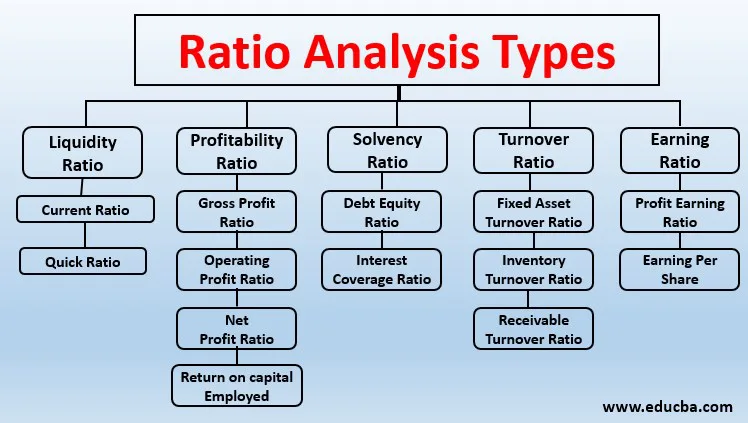

Ratio Analysis Types

Definition of Ratio Analysis

Ratio analysis can be defined as the process of ascertaining the financial ratios that are used for indicating the ongoing financial performance of a company using a few types of ratios such as liquidity, profitability, activity, debt, market, solvency, efficiency, and coverage ratios and few examples of such ratios are return on equity, current ratio, quick ratio, dividend payout ratio, debt-equity ratio, and so on.

Ratio analysis is a process used for the calculation of financial ratios or in other words, for the purpose of evaluating the financial wellbeing of a company. The values used for the calculation of financial ratios of a company are extracted from the financial statements of that same company.

Types of Ratio Analysis

Types of ratios are given below:

1. Liquidity Ratios

This type of ratio helps in measuring the ability of a company to take care of its short-term debt obligations. A higher liquidity ratio represents that the company is highly rich in cash.

The types of liquidity ratios are: –

1. Current Ratio: The current ratio is the ratio between the current assets and current liabilities of a company. The current ratio is used to indicate the liquidity of an organization in being able to meet its debt obligations in the upcoming twelve months. A higher current ratio will indicate that the organization is highly capable of repaying its short-term debt obligations.

2. Quick Ratio: The quick ratio is used to ascertain information pertaining to the capability of a company in paying off its current liabilities on an immediate basis.

The formula used for the calculation of a quick ratio is-

2. Profitability Ratios

This type of ratio helps in measuring the ability of a company in earning sufficient profits.

The types of profitability ratios are: –

1. Gross Profit Ratios: Gross profit ratios are calculated in order to represent the operating profits of an organization after making necessary adjustments pertaining to the COGS or cost of goods sold.

The formula used for the calculation of gross profit ratio is-

2. Net Profit Ratio: Net profit ratios are calculated in order to determine the overall profitability of an organization after reducing both cash and non-cash expenditures.

The formula used for the calculation of net profit ratio is-

3. Operating Profit Ratio: Operating profit ratio is used to determine the soundness of an organization and its financial ability to repay all the short term and long term debt obligations.

The formula used for the calculation of operating profit ratio is-

4. Return on Capital Employed (ROCE): Return on capital employed is used to determine the profitability of an organization with respect to the capital that is invested in the business.

The formula used for the calculation of ROCE is:

3. Solvency Ratios

Solvency ratios can be defined as a type of ratio that is used to evaluate whether a company is solvent and well capable of paying off its debt obligations or not.

The types of solvency ratios are: –

1. Debt Equity Ratio: The debt-equity ratio can be defined as a ratio between total debt and shareholders fund. The debt-equity ratio is used to calculate the leverage of an organization. An ideal debt-equity ratio for an organization is 2:1.

The formula for debt-equity ratio is-

2. Interest Coverage Ratio: The interest coverage ratio is used to determine the solvency of an organization in the nearing time as well as how many times the profits earned by that very organization were capable of absorbing its interest-related expenses.

The formula used for the calculation of interest coverage ratio is-

4. Turnover Ratios

Turnover ratios are used to determine how efficiently the financial assets and liabilities of an organization have been used for the purpose of generating revenues.

The types of turnover ratios are: –

1. Fixed Assets Turnover Ratios: Fixed assets turnover ratio is used to determine the efficiency of an organization in utilizing its fixed assets for the purpose of generating revenues.

The formula used for the determination of fixed assets turnover ratio is-

2. Inventory Turnover Ratio: Inventory turnover ratio is used to determine the speed of a company in converting its inventories into sales.

The formula used for calculating inventory turnover ratio is-

3. Receivable Turnover Ratio: Receivable turnover ratio is used to determine the efficiency of an organization in collecting or realizing its account receivables.

The formula used for calculating the receivable turnover ratio is-

5. Earnings Ratios

Earnings ratio is used for the purpose of determining the returns that an organization generates for its investors.

The types of earnings ratios are: –

1. Profit Earnings Ratio: P/E ratio indicates the profit earning capacity of the company.

The formula used for the calculation of profit earnings ratio is:

2. Earnings per Share (EPS): EPS signifies the earnings of an equity holder based on each share.

The formula used for EPS is:

No comments:

Post a Comment