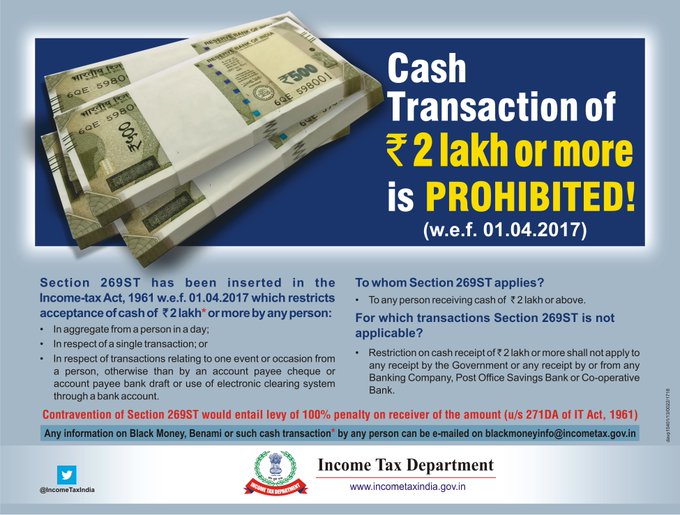

As an effort to check corruption and a further push towards digital payments, the government has capped the cash transactions at Rs. 2 lakh with effective from April 1, 2017. Under Section 269ST of the Income Tax Act, accepting cash of Rs. 2 lakh or more by any individual is restricted. Finance Minister Arun Jaitley in his budget speech had proposed the idea of putting a restriction on cash transactions. The government is closely monitoring all large cash and suspicious transactions.

The Act prohibits such cash dealings on a single day, in respect of a single transaction or transactions relating to one event or occasion from an individual. "Contravention of Section 269ST would entail levy of 100 per cent penalty on receiver of the amount," the Income Tax department said in a tweet.

The restriction is however not applicable to any receipt by government, banking company, post office savings bank or co-operative bank, the tax department added.

Post notes ban, the government has also come up with a black money declaration scheme or Pradhan Mantri Garib Kalyan Yojana (PMGKY) under which people holding unaccounted cash could come clean by declaring their wealth and pay 50 per cent as tax and penalty. So far, the PMGKY scheme has not got a "good response," the government said.

"The response (to the PMGKY) has not been so good...about Rs. 5,000 crore of income was declared in PMGKY," Revenue Secretary Hasmukh Adhia said.

The tax department also advised people to report cash dealings above the permissible limit or any information regarding unaccounted cash by dropping an email to 'blackmoneyinfo@incometax.gov.in '.

The Act prohibits such cash dealings on a single day, in respect of a single transaction or transactions relating to one event or occasion from an individual. "Contravention of Section 269ST would entail levy of 100 per cent penalty on receiver of the amount," the Income Tax department said in a tweet.

The restriction is however not applicable to any receipt by government, banking company, post office savings bank or co-operative bank, the tax department added.

Post notes ban, the government has also come up with a black money declaration scheme or Pradhan Mantri Garib Kalyan Yojana (PMGKY) under which people holding unaccounted cash could come clean by declaring their wealth and pay 50 per cent as tax and penalty. So far, the PMGKY scheme has not got a "good response," the government said.

"The response (to the PMGKY) has not been so good...about Rs. 5,000 crore of income was declared in PMGKY," Revenue Secretary Hasmukh Adhia said.

The tax department also advised people to report cash dealings above the permissible limit or any information regarding unaccounted cash by dropping an email to 'blackmoneyinfo@incometax.gov.in '.

No comments:

Post a Comment