Papia Ghosh Dastidar, 63, has been visiting a branch of Punjab National Bank for several weeks in the recent past, trying to submit the death certificate of her mother and claim the amount left in her savings bank account as the nominee. Every day, she has had to stand in a queue for hours and the amount still hasn’t been transferred to her.

“I am a senior citizen myself. Standing in a queue for so long and coming back repeatedly is too difficult for me,” said Dastidar, a resident of Kolkata. The situation is no different in cities such as Bengaluru, Mumbai, and New Delhi.

Deep Samaddar, 31, a resident of Noida, chose to have his salary account in a private bank to avoid the bureaucratic style of functioning associated with public sector banks.

“I had an account with my mother at the Bank of India, but to get one simple thing done, we had to visit the branch so many times that it becomes difficult,” Samaddar said.

Many customers of state-owned banks have been complaining of poor services, as evident from their social media posts. The complaints include having to stand in queues for hours, visiting a branch repeatedly to complete one task, and regularly hearing that the person whose sign-off is needed is on leave.

Customer service is deteriorating in many branches of public sector banks because there just aren’t enough employees staffing them. One the one hand, state-owned banks have scaled back recruitments and on the other, unhappy employees are leaving public sector banks in search of better opportunities.

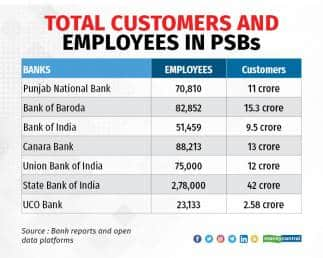

There is hardly one employee for every 1,000 customers in most public sector banks and this increases the work load on existing staffers, bankers said. In private banks, the employee-customer ratio ranges from one in 100 to one in 600.

Considering career prospects and the work environment, many PSB employees, especially youngsters, prefer to join a private bank or company instead of working in a public sector bank.

“There is an aspirational aspect… Youngsters with good academic backgrounds are comparing themselves with others in the private sector like IT companies... Plus, there are quick promotions in the private sector, which don’t happen here,” said BN Mishra, a senior advisor at the Indian Banks’ Association.

Zero active recruitment

Bankers pointed out that public sector banks have cut back on hiring over the years.

“Recruitment has been almost nil in PSBs. The recruitment is either happening through contract basis or a very few placements are happening through lateral entry at the higher level,” said a managerial-level employee with Bank of Baroda (BOB), requesting anonymity.

According to the employee, there has hardly been any active recruitment in the past five years.

“The problem is that the PSBs have to continue with several branches, especially in remote rural areas, even if there is zero profit from those branches. Since profit is going down or branches are running in losses, the impact is evident on the employees. So, there is hardly any initiative to hire more employees,” he said.

No comments:

Post a Comment