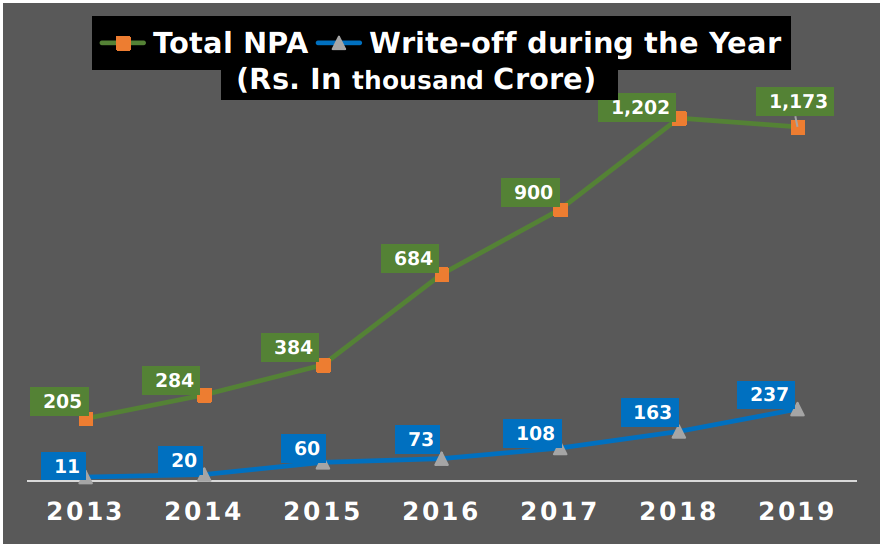

Banks operating in India have written off bad loans worth Rs 660 thousand crore since 2014, as per RBI data studied by NewsClick. The quantum of loans that were written off amounts to half of the total non-performing assets or bad loans that were recorded in the financial books of the banks.

Data published by Reserve Bank of India (RBI) also shows that as much as Rs. 237 thousand crore was written off from the financial books of the banks in financial year 2018-19 alone.

The graph shown below charts the steep rise in the amount being written off, often referred by banks as technical write-offs, allowing them to clean up their books, as the banks fail to recover the loans.

According to the RBI data, NPAs or bad loans on the financial books of banks have also seen a steep rise ever since 2014 – also the year the Bharatiya Janata Party-led government came to power at the Centre.

The total NPAs in 2013-14 amounted Rs. 205 thousand crore, which rose to a whopping Rs 1,173 thousand crore in 2018-2019. This steep rise in NPAs is shocking, especially under the watch of party that promised in its 2014 election manifesto that it would “take necessary steps to reduce NPAs in banking sector.”

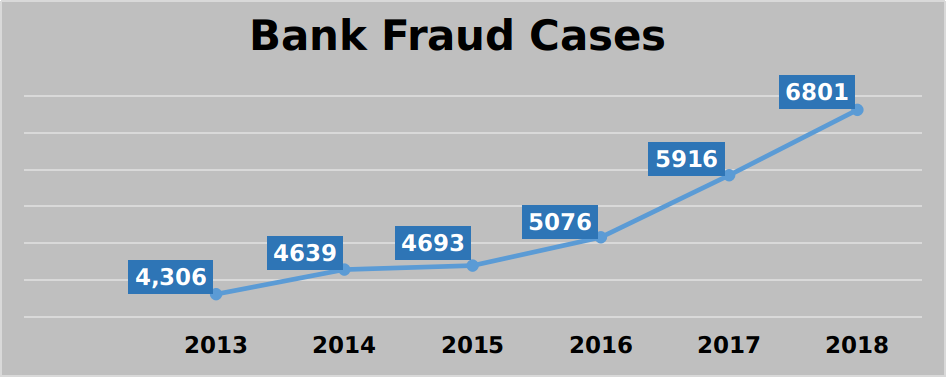

Zooming Bank Fraud Cases

During the same period, the cases of bank frauds also saw a steep rise. Cases of frauds of more than Rs 1 lakh stood at 4,306 in 2012-13, and rose to 6,801 in 2018-19.

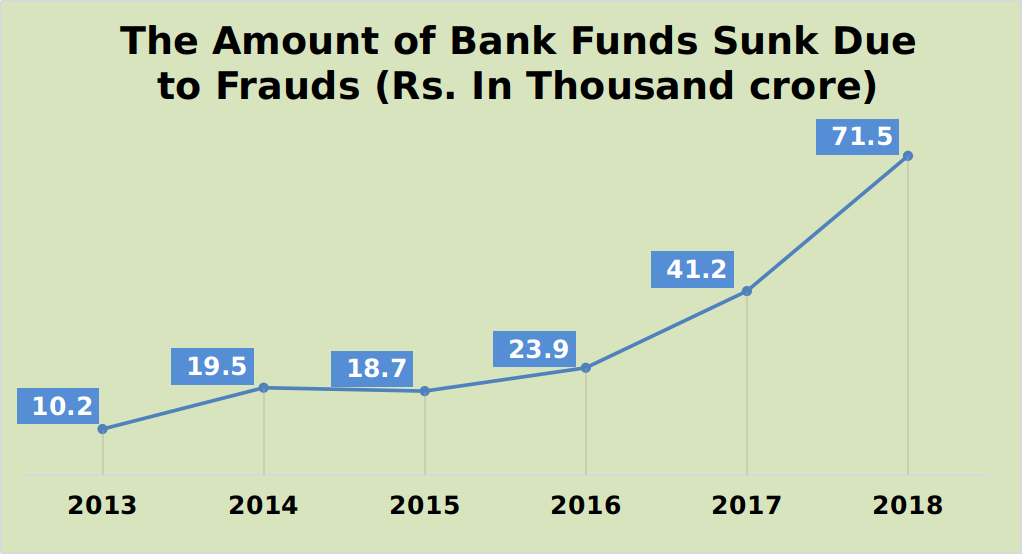

Money Sunk in Bank Fraud Cases

As the number of bank fraud cases increased, so did the amount of money sunk owing to these frauds. According to RBI’s annual report for 2018-19, the amount sunk in March 2013 due to bank frauds was Rs. 10.2 thousand crore, which rose to a shocking Rs 71.5 thousand crore in March 2018.

The impact of rising bad loans and growing cases of bank frauds is already being felt by depositors, the latest example being the collapse of private sector Yes Bank. In on of the biggest ever bank failures in the country, the private lender collapsed, forcing RBI to impose a moratorium on the private lender on March 5. The beleaguered bank is now set to be bailed out with State Bank of India (SBI) being the lead rescuer, along with some private banks.

Often referred by the industry experts, analysts and bank employees’ unions as the reason behind the ‘scrambling’ Indian banking industry, the rising NPAs, written off bad loans, bank fraud cases, paint a sorry picture for the future of the Indian banking system.

1 comment:

Not Modi Bank employees committed or colluded with others to commit fraud.Modi is policy Maker and trusting Bank employees will do their job honestly and efficiently. If some employees feel it is better to earn money by dubious method Modi cannot be blamed.

Post a Comment