The Narendra Modi government may take up the proposal made by MP Shashi Tharoor to increase the tax exemption limit for pension up to Rs 5 lakh during the ongoing preparation for the Union Budget 2018. This comes at the backdrop of the announcement by the Finance Ministry to form a task force to redraft the over the 50-year-old Income Tax Act, 1961.

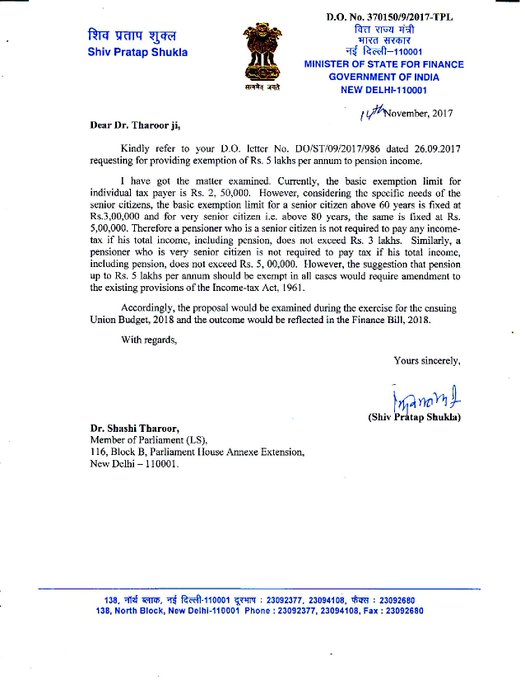

Shashi Tharoor tweeted a letter in which he had received a communication from the government on his request of increasing the tax exemption limit for pension up to Rs 5 lakh. The government said that proposal is being examined and the outcome would be reflected in the Finance Bill, 2018.

The letter, dated November 14, said that a pensioner who is above 80 years is not required to pay tax if the total income, including pension, does not exceed Rs 5 lakh. “The suggestion that pension up to Rs 5 lakh per annum should be exempt in all cases would require an amendment to the existing provisions of the Income Tax Act, 1961,” the letter said.

A pensioner, who is a senior citizen — aged 60 to 80 years — is exempt from income tax if the income, including from pension, does not exceed Rs 3 lakh. The work for preparation of the General Budget has already commenced and Finance Minister Arun Jaitley is likely to present it to Parliament in the first week of February, PTI reported.

Last week, the government formed a ‘Task Force’ to draft a new Direct Tax law to meet the present economic needs of the country, an attempt made by Congress’ P Chidambaram in 2009 through the Direct Taxes Code (DTC). The task force has been given six months to submit its report to the government.

The DTC Bill was introduced in Parliament in 2010 and lapsed with the dissolution of the 15th Lok Sabha. The Bill had proposed annual I-T exemption limit at Rs 2 lakh, and levying 10% tax on income between Rs 2 lakh and Rs 5 lakh, 20% on Rs 5-10 lakh and 30% above Rs 10 lakh. For domestic companies, it suggested tax rate of 30% of business income.

No comments:

Post a Comment