OTHER BLOGS LINK

YOU ARE VISITOR

Blog Archive

LIVE

BREAKING NEWS "

Thursday, November 30, 2017

Expected DA for Feb'18 to Apr'18 for Banker minmum 15 slab and maximum 24 slab

Now, today i.e. on 30.11.2017, CPI for the month Oct'17 announced as 6551.03

We are providing calculations of expected DA on the basis of three assumption as under :-

- On assumptions that CPI would remain at least same as of Oct'17 for the next two month i.e. for Nov'17 & Dec'17. In this situation the expected (tentatively) increase in DA Slabs would come to 12 slabs.(on this assumption the total tentatively revised DA slabs would be 528 i.e. 52.80%)

- On assumptions that there would be increase of one point in CPI data in both the remaining months. In this situation the expected (tentatively) decrease in DA Slabs would come to 17 slabs.(on this assumption the total tentatively revised DA slabs would be 533 i.e. 53.30%)

- Keeping in view the recent fuel price hike we assume that there be may an increase of two points Nov'17 and One point increase in Dec'17, In this situation the expected (tentatively) increase in DA Slabs would come to 21 slabs.(on this assumption the total tentatively revised DA slabs would be 537 i.e. 53.70%)

- Keeping in view the recent market scenario like fuel price gold and food grain may an increase order. 15 essential goods price are in increasing order as per govt list. in such scenario if in both month two point increases i.e in nob 2 point and in dec also 2 point then DA will be 26 slab.AS per our expectation Da will be increase from Feb 2017 minimum 15 maximum 24

Wednesday, November 29, 2017

Has Modi government really waived loans of capitalists? This could be the truth

In the wake of allegations that Narendra Modigovernment has waived the loans of leading capitalists of the country by opposition parties and critics, Union Finance Minister Arun Jaitley has called it a “fiction” and also come up with an article to debunk the rumours, which started after the Centre decided to pump in over Rs 2 lakh crore to revitalise the banking sector. Last year, some opposition leaders including Delhi CM Arvind Kejriwal had alleged that PM Modi demonetised old Rs 500 and Rs 1000 notes in a bid to waive the loans of big businesses while putting the poor people of the country in trouble.

When the bank recapitalisation decision was announced recently, opposition leaders alleged what they had feared came true. However, the allegations were denied by the Centre. Now, in an article, Jaitley has explained as to how the allegation against bank recapitalisation is just “fiction”. In an article titled “The Fiction of Loan Waiver to Capitalists”, Jaitley made the following points, saying “Time has come for the nation to be apprised of facts in this regard.”

- Jaitley said that during 2010‐11 to 2013‐14, the then government provided banks an amount of Rs. 44,000 crore for recapitalisation. he asked, “Was that also for waiving loans of capitalists?”

- According to the Finance Minister, Public Sector Banks had disbursed “disproportionate sums of loans” to industries between 2008 and 2014. In the period, “the gross advances of Public Sector Banks increased from about Rs. 34,00,000 crore. Despite repayment not being regular on these, through relaxation in loan classification, banks continued to keep defaulters as non‐NPA account holders by restructuring them ” and “losses of banks and their precarious position was kept under the carpet.”

- Jaitley said the UPA government, with the help of relaxation by banks in loan classification, kept defaulters as non‐NPA account holders. The loans were restructured and loss to banks was kept hidden.

- Modi government’s took decisions to break the nexus. “Insolvency and Bankruptcy Code was enacted, and by amending it, in respect of companies whose money was not returned to the banks, decision was taken that the debtors concerned would not be allowed to participate in the business of such companies,” Jaitley wrote.

- On Bank recapitalisation decision, Jaitley said it was done “so that Public Sector Banks become strong and capable of contributing to nation’s development.” That these banks may become “mazboot, i.e., strong, rather than mazboor, i.e., hard‐pressed,” he said.

- And Asset Quality Review was carried out for clean and fully provisioned balance‐sheets in 2015. It revealed high NPA of Public Sector Banks, increased from Rs. 2,78,000 crore in March 2015 to Rs. 7,33,000 crore in June 2017. Jaitley said, “those loans, of about Rs. 4,54,466 crore, which were actually fit to be NPA and were under the carpet, were recognised after intensive scrutiny.”

- Were loans of capitalists waived? Jaitley said ‘no’. He wrote, “Government has not waived any loans of big NPA defaulters.” Instead, under new Insolvency and Bankruptcy Code, “cases have been instituted in the National Company Law Tribunal (NCLT) for timebound recovery from 12 largest defaulters in six to nine months, in NPA cases of Rs. 1,75,000 crore.” The FM said that cases for recovery of NPA dues from the assets of big defaulters are under way at various stages.

- Wilful defaulters barred: Jaitley said that through an ordinance this week, Modi government has barred wilful defaulters and persons associated with NPA accounts from participating in the process under way in NCLT.

ONLY nine banks that will gain out of PSU recapitalisation

The Indian banking sector, especially the state-owned entities, have hogged the limelight as the government’s announcement of a fiscal neutral capitalisation raised hopes of a revival of not only these entities but also the long-buried capex cycle. The quarterly results, therefore, got somewhat relegated to the background. Now that the dust appears to be settling, it is worth checking on the numbers as well as the grand recapitalisation plans to explore if the fortunes of the sector are really changing or is it another hope rally that is likely to dissipate?

PSU Banks in Q218

The analysis of the 21 listed PSU (public sector) banks suggest an improvement in operating performance with a sequential growth in operating profit. However, the higher provisioning mostly on account of the bad assets that have been referred to NCLT (National Company Law Tribunal) dented profitability.

So, the overall profitability of the banking sector was driven by the private sector, which delivered a bottomline of Rs 10,632 crore.

NPL addition falling

What stood out in the quarterly performance of PSU banks was the muted net addition to gross NPL (non-performing loan). For the aggregate, the net addition to the stock of NPL was only Rs 1,959 crore which is a sharp decline from the previous quarter. Individual results from the banks also point to declining slippages quarter-on-quarter. Thanks to the higher provision, the overall provision coverage ratio (the percentage of provision that a bank carries against its bad loans) for the group improved by 280 basis points to 46 percent.

The road ahead

However, the future roadmap is contingent on two parameters – business growth and asset quality -- that deserves greater scrutiny.

Lack of capital, and asset quality concerns of PSU banks have been a boon for many of their private sector counterparts as evident from the incremental market share gains in the first half of the current fiscal.

What has worsened the situation for PSU banks is the well-known asset quality problem and lack of core capital to expand business. A large number of banks have CET1 (common equity tier 1) ratio that is below the required 8 percent minimum that will be applicable from FY19.

The danger signals

If one were to prudently adjust the net non-performing assets from the core capital of the banks, some of the banks of the likes of Bank of Maharashtra, Central Bank, Corporation Bank, IDBI Bank, Indian Overseas Bank, UCO Bank and United Bank have completely eroded their capital. In fact, most of these entities are actually de-growing their asset book and have very little visibility. It is worth noting that the combined balance sheet of these chronically troubled entities is close to Rs 17.8 lakh crore with the size of the asset book of approximately Rs 10.6 lakh crore. It is a question of time before these businesses migrate to stronger PSUs or private sector banks.

Will the Great Indian Capitalisation salvage all?

The answer, although premature, may be unequivocally no. If one looks at the aggregate number, the picture is crystal clear. At the end of September 2017, the stock of NPA that doesn’t carry provisions is approximately Rs 4 lakh crore.. If one considers the declared restructured assets of the PSU banks to the tune of Rs 1.7 lakh crore, then on this Rs 5.7 lakh crore if conservatively a provision of 45 percent were to be created in the next two years, the provisioning requirement will be close to Rs 2.6 lakh crore. . In essence, it means the recapitalisation amount (Rs 2.11 lakh crore) will mostly be used up for provisioning on assets that are already turning sour without providing much life to the patient in critical care, leave alone the medicine to make them run. So the weak are unlikely to turn strong because of this exercise alone.

In the coming six to eight quarters, the PSU banks may continue to show elevated provisions that might impact profitability, although incremental slippage may not rise.

Back to survival of the fittest?

The government is likely to distribute this capital wisely to make the well-run banks stronger, perhaps with more autonomy and flexibility on top of capital to enable them to truly compete in the global arena. So investors have got to be discerning in choosing their bets.

We feel that well-capitalised private entities will continue to gain market share at the expense of PSU banks as the provisioning pain will linger on for a while for government banks. Although recapitalisation will gradually start alongside resolution of stressed assets, the big issue of restructuring and right sizing of PSU banks might have to wait beyond the General Election of 2019.

However, we are hopeful of some serious gains coming out of this bank recapitalisation/restructuring exercise in the medium to long term. While we do not wish to speculate on the survivors, we have identified nine banks (the six relatively large ones -- State Bank of India, Punjab National Bank, Bank of India, Bank of Baroda, Canara Bank and Union Bank) and three better-managed smaller entities -- Indian Bank, Syndicate Bank and Vijaya Bank-- that will catch investor fancy as the sector remains at the pinnacle of action.

Tuesday, November 28, 2017

Public Sector Banks may face Rs 40,000-cr loss due to bad loans in MARCH 2018

Commercial banks wrote off about Rs 35,000 crore of bad loans in July-September, taking write-offs to Rs 65,800 crore in the first half of the financial year.

Credit costs — the amount set aside for bad loans and stressed assets — for ageing non-performing assets (NPAs) and National Company Law Tribunal cases would take provision coverage ratio to 58-60 per cent by the end of FY18, from 44.3 per cent at the end of March 2017, according to rating agency ICRA.

Banks’ credit provisions surged to Rs 64,500 crore during Q2 FY18, up 40 per cent on a sequential basis and 30 per cent on a year-on-year basis. For April-September FY18, the total credit provisions were up 17 per cent on a year-on-year basis at Rs 1.1 lakh crore.

The total exposure of Rs 3 lakh crore of accounts is likely to be resolved under the Insolvency and Bankruptcy Code (IBC). And the overall credit provisions are likely to be at Rs 2.4-2.6 lakh crore (including impact of ageing on existing NPAs and provisioning on IBC accounts) for FY18, against Rs 2 lakh crore during FY17,” ICRA said. Out of this, requirement provisions of NCLT cases on lists 1 and 2 (see chart) are Rs 45,000-60,000 crore in the second half of the current financial year. Most of the burden would fall on public sector banks(PSBs). This can result in losses before taxes of Rs 30,000-40,000 crore for PSBs during FY18.

Fresh slippages during Q2 FY18 stood at 3.9 per cent (annualised), the lowest since the beginning of the asset quality review initiated by the Reserve Bank of India during Q3 FY16. More than 80 per cent of the slippages during the quarter were outside the standard restructured advances. The slippages ratio was 6.3 per cent (annualised) during Q1 FY18 and 5.5 per cent for FY17. ICRA said the asset quality pain was likely to continue in the near term with Rs 1.7 lakh crore of standard restructured advances.

Source- Business standard

Source- Business standard

Nationalization Of Banks Was A Drama-- PM Modi

Sharpening his attack on the Congress in his home state, Prime Minister Narendra Modi on Monday said the erstwhile Indira Gandhi government played the "drama" of nationalising banks to "cover up" the "unceremonious" sacking of then Finance Minister Morarji Desai, a Gujarati.

Addressing a rally in Kadodara area of the city ahead of the first phase polling on December 9, PM Modi also accused the Congress of creating a "rift" in the society through its "caste-based" politics and said Gujarat is still paying the price of their "sins" committed 25 years ago.

He said nationalisation of banks was a "drama" played by the erstwhile Congress government to "cover up" the sacking of Mr Desai.

"Immediately after sacking him ( Mr Desai), banks were nationalised overnight as part of the government's face-saving exercise (though) it was claimed that banks were nationalised to serve the poor," he said.

PM Modi said despite "sacrificing" Mr Desai, the doors of banks did not open for the poor.

The prime minister said it was his government which actually opened the doors of the banks for the poor.

"When we came to power (in 2014), those doors that were closed for almost 30 crore poor, we then opened those doors by introducing the PM Jan Dhan Yojna," he added.

In a veiled dig at Congress vice-president Rahul Gandhi, PM Modi said the BJP during its rule in Gujarat has "forced" people to visit temples.

"They (Congress leaders) ask me what BJP did in this 22 years (rule in Gujarat). (Among others things) We have compelled many people to visit temples," PM Modi said evoking a loud cheer from the crowd.

Mr Gandhi, who visited a string of temples during his party's ongoing campaign in Gujarat, has been accused by the BJP of playing the "soft Hindutva card".

Monday, November 27, 2017

Good news in making for pensioners! Pension income up to Rs 5 lakh a year may be tax exempt

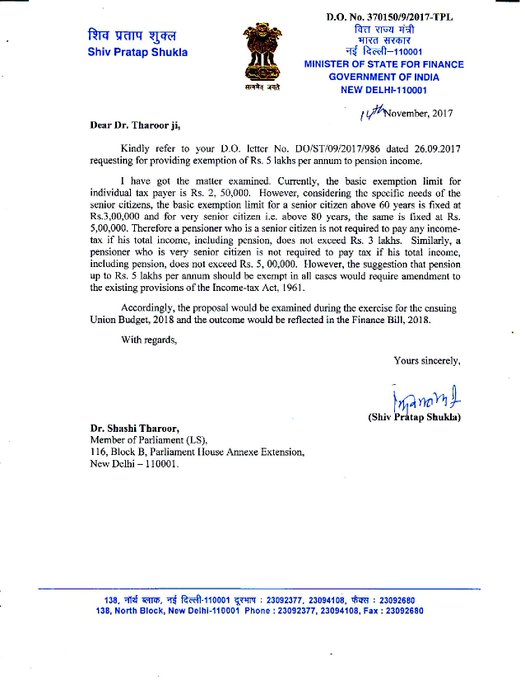

The Narendra Modi government may take up the proposal made by MP Shashi Tharoor to increase the tax exemption limit for pension up to Rs 5 lakh during the ongoing preparation for the Union Budget 2018. This comes at the backdrop of the announcement by the Finance Ministry to form a task force to redraft the over the 50-year-old Income Tax Act, 1961.

Shashi Tharoor tweeted a letter in which he had received a communication from the government on his request of increasing the tax exemption limit for pension up to Rs 5 lakh. The government said that proposal is being examined and the outcome would be reflected in the Finance Bill, 2018.

The letter, dated November 14, said that a pensioner who is above 80 years is not required to pay tax if the total income, including pension, does not exceed Rs 5 lakh. “The suggestion that pension up to Rs 5 lakh per annum should be exempt in all cases would require an amendment to the existing provisions of the Income Tax Act, 1961,” the letter said.

Govt's semi-encouraging reply to my request to exempt pensioners from tax on the first 5 lakhs of income. Hope @arunjaitley will include this in his next budget.

A pensioner, who is a senior citizen — aged 60 to 80 years — is exempt from income tax if the income, including from pension, does not exceed Rs 3 lakh. The work for preparation of the General Budget has already commenced and Finance Minister Arun Jaitley is likely to present it to Parliament in the first week of February, PTI reported.

Last week, the government formed a ‘Task Force’ to draft a new Direct Tax law to meet the present economic needs of the country, an attempt made by Congress’ P Chidambaram in 2009 through the Direct Taxes Code (DTC). The task force has been given six months to submit its report to the government.

The DTC Bill was introduced in Parliament in 2010 and lapsed with the dissolution of the 15th Lok Sabha. The Bill had proposed annual I-T exemption limit at Rs 2 lakh, and levying 10% tax on income between Rs 2 lakh and Rs 5 lakh, 20% on Rs 5-10 lakh and 30% above Rs 10 lakh. For domestic companies, it suggested tax rate of 30% of business income.

Sunday, November 26, 2017

Banking Ombudsman Scheme, 2006 details read the full articles please..........

Banking Ombudsman Scheme, 2006

(Updated as on July 14, 2017)

1. What is the Banking Ombudsman Scheme?

The Banking Ombudsman Scheme is an expeditious and inexpensive forum for bank customers for resolution of complaints relating to certain services rendered by banks. The Banking Ombudsman Scheme is introduced under Section 35 A of the Banking Regulation Act, 1949 by RBI with effect from 1995. Presently the Banking Ombudsman Scheme 2006 (As amended upto July 1, 2017) is in operation.

2. Who is a Banking Ombudsman?

The Banking Ombudsman is a senior official appointed by the Reserve Bank of India to redress customer complaints against deficiency in certain banking services covered under the grounds of complaint specified under Clause 8 of the Banking Ombudsman Scheme 2006 (As amended upto July 1, 2017).

3. How many Banking Ombudsmen have been appointed and where are they located?

As on date, twenty Banking Ombudsmen have been appointed with their offices located mostly in state capitals. The addresses and contact details of the Banking Ombudsman offices have been provided under Annex I of the Scheme.

4. Which are the banks covered under the Banking Ombudsman Scheme, 2006?

All Scheduled Commercial Banks, Regional Rural Banks and Scheduled Primary Co-operative Banks are covered under the Scheme.

5. What are the grounds of complaints?

The Banking Ombudsman can receive and consider any complaint relating to the following deficiency in banking services:

non-payment or inordinate delay in the payment or collection of cheques, drafts, bills etc.;

non-acceptance, without sufficient cause, of small denomination notes tendered for any purpose, and for charging of commission in respect thereof;

non-acceptance, without sufficient cause, of coins tendered and for charging of commission in respect thereof;

non-payment or delay in payment of inward remittances ;

failure to issue or delay in issue of drafts, pay orders or bankers’ cheques;

non-adherence to prescribed working hours ;

failure to provide or delay in providing a banking facility (other than loans and advances) promised in writing by a bank or its direct selling agents;

delays, non-credit of proceeds to parties' accounts, non-payment of deposit or non-observance of the Reserve Bank directives, if any, applicable to rate of interest on deposits in any savings, current or other account maintained with a bank ;

complaints from Non-Resident Indians having accounts in India in relation to their remittances from abroad, deposits and other bank related matters;

refusal to open deposit accounts without any valid reason for refusal;

levying of charges without adequate prior notice to the customer;

Non-adherence to the instructions of Reserve Bank on ATM / Debit Card and Prepaid Card operations in India by the bank or its subsidiaries

Non-adherence by the bank or its subsidiaries to the instructions of Reserve Bank on credit card operations

Non-adherence to the instructions of Reserve Bank with regard to Mobile Banking / Electronic Banking service in India by the bank

Non-disbursement or delay in disbursement of pension (to the extent the grievance can be attributed to the action on the part of the bank concerned, but not with regard to its employees);

Refusal to accept or delay in accepting payment towards taxes, as required by Reserve Bank/Government;

Refusal to issue or delay in issuing, or failure to service or delay in servicing or redemption of Government securities;

Forced closure of deposit accounts without due notice or without sufficient reason;

Refusal to close or delay in closing the accounts;

Non-adherence to the fair practices code as adopted by the bank;

Non-adherence to the provisions of the Code of Bank's Commitments to Customers issued by Banking Codes and Standards Board of India and as adopted by the bank ;

Non-observance of Reserve Bank guidelines on engagement of recovery agents by banks;

Non-adherence to Reserve Bank guidelines on para-banking activities like sale of insurance / mutual fund /other third party investment products by banks

Any other matter relating to the violation of the directives issued by the Reserve Bank in relation to banking or other services.

A customer can also lodge a complaint on the following grounds of deficiency in service with respect to loans and advances

non-observance of Reserve Bank Directives on interest rates;

delays in sanction, disbursement or non-observance of prescribed time schedule for disposal of loan applications;

non-acceptance of application for loans without furnishing valid reasons to the applicant; and

non-adherence to the provisions of the fair practices code for lenders as adopted by the bank or Code of Bank’s Commitment to Customers, as the case may be;

non-observance of any other direction or instruction of the Reserve Bank as may be specified by the Reserve Bank for this purpose from time to time.

The Banking Ombudsman may also deal with such other matter as may be specified by the Reserve Bank from time to time.

6. When can one file a complaint?

One can file a complaint before the Banking Ombudsman if the reply is not received from the bank within a period of one month after the bank concerned has received one's complaint, or the bank rejects the complaint, or if the complainant is not satisfied with the reply given by the bank.

7. When will one's complaint not be considered by the Ombudsman?

One's complaint will not be considered if:

One has not approached his bank for redressal of his grievance first.

One has not made the complaint within one year from the date of receipt of the reply of the bank or if no reply is received, and the complaint to Banking Ombudsman is made after the lapse of more than one year and one month from the date of complaint made to the bank.

The subject matter of the complaint is pending for disposal / has already been dealt with at any other forum like court of law, consumer court etc.

Frivolous or vexatious complaints.

The institution complained against is not covered under the scheme.

The subject matter of the complaint is not pertaining to the grounds of complaint specified under Clause 8 of the Banking Ombudsman Scheme. If the complaint is for the same subject matter that was settled through the office of the Banking Ombudsman in any previous proceedings.

8. What is the procedure for filing the complaint before the Banking Ombudsman?

One can file a complaint with the Banking Ombudsman simply by writing on a plain paper. One can also file it online at (“click here to lodge a complaint”) or by sending an email to the Banking Ombudsman. There is a form along with details of the scheme in Rbi website. However, it is not mandatory to use this format.

9. Where can one lodge his/her complaint?

One may lodge his/ her complaint at the office of the Banking Ombudsman under whose jurisdiction, the bank branch complained against is situated.

For complaints relating to credit cards and other types of services with centralized operations, complaints may be filed before the Banking Ombudsman within whose territorial jurisdiction the billing address of the customer is located.

10. Can a complaint be filed by one s authorized representative?

Yes. The complainant can be filed by one s authorized representative (other than an advocate).

11. Is there any cost involved in filing complaints with Banking Ombudsman?

No. The Banking Ombudsman does not charge any fee for filing and resolving customers’ complaints.

12. Is there any limit on the amount of compensation as specified in an Award?

The amount, if any, to be paid by the bank to the complainant by way of compensation for any loss suffered by the complainant is limited to the amount arising directly out of the act or omission of the bank or ₹ 20 lakhs (₹ Two Million), whichever is lower.

13. Can compensation be claimed for mental agony and harassment?

The Banking Ombudsman may award compensation not exceeding ₹ 1 lakh (₹ One Hundred Thousand) to the complainant for mental agony and harassment. The Banking Ombudsman will take into account the loss of the complainant's time, expenses incurred by the complainant, harassment and mental anguish suffered by the complainant while passing such award.

14. What details are required in the application?

Name and address of the complainant, the name and address of the branch or office of the bank against which the complaint is made, facts giving rise to the complaint supported by documents, if any, the nature and extent of the loss caused to the complainant, the relief sought from the Banking Ombudsman and a declaration about the compliance with conditions which are required to be complied with by the complainant under Clause 9(3) of the Banking Ombudsman Scheme.

15. What happens after a complaint is received by the Banking Ombudsman?

The Banking Ombudsman endeavours to promote, through conciliation or mediation, a settlement of the complaint by agreement between the complainant and the bank named in the complaint.

If the terms of settlement (offered by the bank) are acceptable to one in full and final settlement of one's complaint, the Banking Ombudsman will pass an order as per the terms of settlement which becomes binding on the bank and the complainant.

16. Can the Banking Ombudsman reject a complaint at any stage?

Yes. The Banking Ombudsman may reject a complaint at any stage if it appears to him that a complaint made to him is:

not on the grounds of complaint referred to above

compensation sought from the Banking Ombudsman is beyond ₹ 20 lakh (₹ Two Million).

requires consideration of elaborate documentary and oral evidence and the proceedings before the Banking Ombudsman are not appropriate for adjudication of such complaint

the complaint is without any sufficient cause

the complaint that it is not pursued by the complainant with reasonable diligence

in the opinion of the Banking Ombudsman there is no loss or damage or inconvenience caused to the complainant.

17. What happens if the complaint is not settled by agreement?

If a complaint is not settled by an agreement within a period of one month, the Banking Ombudsman proceeds further to pass an Award. Before passing an award, the Banking Ombudsman provides reasonable opportunity to the complainant and the bank, to present their case.

It is up to the complainant to accept the award in full and final settlement of or to reject it.

18. Is there any further recourse available if one rejects the Banking Ombudsman’s decision?

Any person aggrieved by an Award issued under Clause 12 or the decision of the Banking Ombudsman rejecting the complaint for the reasons specified in sub-clause (d) to (g) of Clause 13 of the Banking Ombudsman Scheme 2006 (As amended up to July 1, 2017) can approach the Appellate Authority. The Appellate Authority is vested with a Deputy Governor of the RBI.

Other recourse and/or remedies available to him/her as per the law can also be explored. The bank also has the option to file an appeal before the Appellate Authority under the Scheme.

19. Is there any time limit for filing an appeal?

One can file the appeal against the award or decision of the Banking Ombudsman rejecting the complaint within 30 days of the date of receipt of the Award, The Appellate Authority may, if he/ she is satisfied that the applicant had sufficient cause for not making an application for appeal within time, also allow a further period not exceeding 30 days.

20. How does the appellate authority deal with the appeal?

The appellate authority may:

dismiss the appeal; or

allow the appeal and set aside the Award; or

send the matter to the Banking Ombudsman for fresh disposal in accordance with such directions as the appellate authority may consider necessary or proper; or

modify the Award and pass such directions as may be necessary to give effect to the modified award; or

pass any other order as it may deem fit.

Banking Ombudsman Scheme, 2006

(Updated as on July 14, 2017)

1. What is the Banking Ombudsman Scheme?

The Banking Ombudsman Scheme is an expeditious and inexpensive forum for bank customers for resolution of complaints relating to certain services rendered by banks. The Banking Ombudsman Scheme is introduced under Section 35 A of the Banking Regulation Act, 1949 by RBI with effect from 1995. Presently the Banking Ombudsman Scheme 2006 (As amended upto July 1, 2017) is in operation.

2. Who is a Banking Ombudsman?

The Banking Ombudsman is a senior official appointed by the Reserve Bank of India to redress customer complaints against deficiency in certain banking services covered under the grounds of complaint specified under Clause 8 of the Banking Ombudsman Scheme 2006 (As amended upto July 1, 2017).

3. How many Banking Ombudsmen have been appointed and where are they located?

As on date, twenty Banking Ombudsmen have been appointed with their offices located mostly in state capitals. The addresses and contact details of the Banking Ombudsman offices have been provided under Annex I of the Scheme.

4. Which are the banks covered under the Banking Ombudsman Scheme, 2006?

All Scheduled Commercial Banks, Regional Rural Banks and Scheduled Primary Co-operative Banks are covered under the Scheme.

5. What are the grounds of complaints?

The Banking Ombudsman can receive and consider any complaint relating to the following deficiency in banking services:

non-payment or inordinate delay in the payment or collection of cheques, drafts, bills etc.;

non-acceptance, without sufficient cause, of small denomination notes tendered for any purpose, and for charging of commission in respect thereof;

non-acceptance, without sufficient cause, of coins tendered and for charging of commission in respect thereof;

non-payment or delay in payment of inward remittances ;

failure to issue or delay in issue of drafts, pay orders or bankers’ cheques;

non-adherence to prescribed working hours ;

failure to provide or delay in providing a banking facility (other than loans and advances) promised in writing by a bank or its direct selling agents;

delays, non-credit of proceeds to parties' accounts, non-payment of deposit or non-observance of the Reserve Bank directives, if any, applicable to rate of interest on deposits in any savings, current or other account maintained with a bank ;

complaints from Non-Resident Indians having accounts in India in relation to their remittances from abroad, deposits and other bank related matters;

refusal to open deposit accounts without any valid reason for refusal;

levying of charges without adequate prior notice to the customer;

Non-adherence to the instructions of Reserve Bank on ATM / Debit Card and Prepaid Card operations in India by the bank or its subsidiaries

Non-adherence by the bank or its subsidiaries to the instructions of Reserve Bank on credit card operations

Non-adherence to the instructions of Reserve Bank with regard to Mobile Banking / Electronic Banking service in India by the bank

Non-disbursement or delay in disbursement of pension (to the extent the grievance can be attributed to the action on the part of the bank concerned, but not with regard to its employees);

Refusal to accept or delay in accepting payment towards taxes, as required by Reserve Bank/Government;

Refusal to issue or delay in issuing, or failure to service or delay in servicing or redemption of Government securities;

Forced closure of deposit accounts without due notice or without sufficient reason;

Refusal to close or delay in closing the accounts;

Non-adherence to the fair practices code as adopted by the bank;

Non-adherence to the provisions of the Code of Bank's Commitments to Customers issued by Banking Codes and Standards Board of India and as adopted by the bank ;

Non-observance of Reserve Bank guidelines on engagement of recovery agents by banks;

Non-adherence to Reserve Bank guidelines on para-banking activities like sale of insurance / mutual fund /other third party investment products by banks

Any other matter relating to the violation of the directives issued by the Reserve Bank in relation to banking or other services.

A customer can also lodge a complaint on the following grounds of deficiency in service with respect to loans and advances

non-observance of Reserve Bank Directives on interest rates;

delays in sanction, disbursement or non-observance of prescribed time schedule for disposal of loan applications;

non-acceptance of application for loans without furnishing valid reasons to the applicant; and

non-adherence to the provisions of the fair practices code for lenders as adopted by the bank or Code of Bank’s Commitment to Customers, as the case may be;

non-observance of any other direction or instruction of the Reserve Bank as may be specified by the Reserve Bank for this purpose from time to time.

The Banking Ombudsman may also deal with such other matter as may be specified by the Reserve Bank from time to time.

6. When can one file a complaint?

One can file a complaint before the Banking Ombudsman if the reply is not received from the bank within a period of one month after the bank concerned has received one's complaint, or the bank rejects the complaint, or if the complainant is not satisfied with the reply given by the bank.

7. When will one's complaint not be considered by the Ombudsman?

One's complaint will not be considered if:

One has not approached his bank for redressal of his grievance first.

One has not made the complaint within one year from the date of receipt of the reply of the bank or if no reply is received, and the complaint to Banking Ombudsman is made after the lapse of more than one year and one month from the date of complaint made to the bank.

The subject matter of the complaint is pending for disposal / has already been dealt with at any other forum like court of law, consumer court etc.

Frivolous or vexatious complaints.

The institution complained against is not covered under the scheme.

The subject matter of the complaint is not pertaining to the grounds of complaint specified under Clause 8 of the Banking Ombudsman Scheme. If the complaint is for the same subject matter that was settled through the office of the Banking Ombudsman in any previous proceedings.

8. What is the procedure for filing the complaint before the Banking Ombudsman?

One can file a complaint with the Banking Ombudsman simply by writing on a plain paper. One can also file it online at (“click here to lodge a complaint”) or by sending an email to the Banking Ombudsman. There is a form along with details of the scheme in Rbi website. However, it is not mandatory to use this format.

9. Where can one lodge his/her complaint?

One may lodge his/ her complaint at the office of the Banking Ombudsman under whose jurisdiction, the bank branch complained against is situated.

For complaints relating to credit cards and other types of services with centralized operations, complaints may be filed before the Banking Ombudsman within whose territorial jurisdiction the billing address of the customer is located.

10. Can a complaint be filed by one s authorized representative?

Yes. The complainant can be filed by one s authorized representative (other than an advocate).

11. Is there any cost involved in filing complaints with Banking Ombudsman?

No. The Banking Ombudsman does not charge any fee for filing and resolving customers’ complaints.

12. Is there any limit on the amount of compensation as specified in an Award?

The amount, if any, to be paid by the bank to the complainant by way of compensation for any loss suffered by the complainant is limited to the amount arising directly out of the act or omission of the bank or ₹ 20 lakhs (₹ Two Million), whichever is lower.

13. Can compensation be claimed for mental agony and harassment?

The Banking Ombudsman may award compensation not exceeding ₹ 1 lakh (₹ One Hundred Thousand) to the complainant for mental agony and harassment. The Banking Ombudsman will take into account the loss of the complainant's time, expenses incurred by the complainant, harassment and mental anguish suffered by the complainant while passing such award.

14. What details are required in the application?

Name and address of the complainant, the name and address of the branch or office of the bank against which the complaint is made, facts giving rise to the complaint supported by documents, if any, the nature and extent of the loss caused to the complainant, the relief sought from the Banking Ombudsman and a declaration about the compliance with conditions which are required to be complied with by the complainant under Clause 9(3) of the Banking Ombudsman Scheme.

15. What happens after a complaint is received by the Banking Ombudsman?

The Banking Ombudsman endeavours to promote, through conciliation or mediation, a settlement of the complaint by agreement between the complainant and the bank named in the complaint.

If the terms of settlement (offered by the bank) are acceptable to one in full and final settlement of one's complaint, the Banking Ombudsman will pass an order as per the terms of settlement which becomes binding on the bank and the complainant.

16. Can the Banking Ombudsman reject a complaint at any stage?

Yes. The Banking Ombudsman may reject a complaint at any stage if it appears to him that a complaint made to him is:

not on the grounds of complaint referred to above

compensation sought from the Banking Ombudsman is beyond ₹ 20 lakh (₹ Two Million).

requires consideration of elaborate documentary and oral evidence and the proceedings before the Banking Ombudsman are not appropriate for adjudication of such complaint

the complaint is without any sufficient cause

the complaint that it is not pursued by the complainant with reasonable diligence

in the opinion of the Banking Ombudsman there is no loss or damage or inconvenience caused to the complainant.

17. What happens if the complaint is not settled by agreement?

If a complaint is not settled by an agreement within a period of one month, the Banking Ombudsman proceeds further to pass an Award. Before passing an award, the Banking Ombudsman provides reasonable opportunity to the complainant and the bank, to present their case.

It is up to the complainant to accept the award in full and final settlement of or to reject it.

18. Is there any further recourse available if one rejects the Banking Ombudsman’s decision?

Any person aggrieved by an Award issued under Clause 12 or the decision of the Banking Ombudsman rejecting the complaint for the reasons specified in sub-clause (d) to (g) of Clause 13 of the Banking Ombudsman Scheme 2006 (As amended up to July 1, 2017) can approach the Appellate Authority. The Appellate Authority is vested with a Deputy Governor of the RBI.

Other recourse and/or remedies available to him/her as per the law can also be explored. The bank also has the option to file an appeal before the Appellate Authority under the Scheme.

19. Is there any time limit for filing an appeal?

One can file the appeal against the award or decision of the Banking Ombudsman rejecting the complaint within 30 days of the date of receipt of the Award, The Appellate Authority may, if he/ she is satisfied that the applicant had sufficient cause for not making an application for appeal within time, also allow a further period not exceeding 30 days.

20. How does the appellate authority deal with the appeal?

The appellate authority may:

dismiss the appeal; or

allow the appeal and set aside the Award; or

send the matter to the Banking Ombudsman for fresh disposal in accordance with such directions as the appellate authority may consider necessary or proper; or

modify the Award and pass such directions as may be necessary to give effect to the modified award; or

pass any other order as it may deem fit.

Subscribe to:

Comments (Atom)

-

Changes in leave rules for bank employees and Bank officers were updated in terms of the 12th BPS/9th Joint Note dated 08.03.2024 This post ...

-

The Government of India has approved a new transfer policy for Public Sector Bank Employees. This new policy will be applicable from 1st Apr...

-

1. Bank of Maharashtra - 15 days PLI 2. UCO Bank - 5 days PLI 3. Central Bank of India - 5 days PLI 4. Indian Bank - 10 days PLI 5. SBI...

script async src="https://pagead2.googlesyndication.com/pagead/js/adsbygoogle.js">