The Finance Minister Nirmala Sitharaman announced the Government’s plan of conducting privatisation of two public sector banks besides IDBI Bank in FY22, in her Budget speech on February 1.

The finance ministry will be working in conjunction with the Reserve bank of India to execute the process.

Amidst the Government’s disinvestment drive going on, Trak.in has information that the country’s only public sector bank set up by PM Modi, is on its way towards a possible verge of failure.

We are speaking of ‘India Post Payments Bank’, owned 100% by the Government of India and set up in 2018 by Shri. Narendra Modi.

IPPS Paying Reduced Salaries to Employees

India Post Payments Bank, set up by PM Modi in 2018, under the Ministry of Communication is 100% owned by the Government of India and currently holds over 4 crore accounts, with thousands of crores of deposits from the public in just 2.5 years.

Trak.in has received exclusive information from an employee of the public bank, claiming that they have been paid a reduced amount of salary for the month of January 2021, against the revised salary as per the 11th Bipartite settlement.

The Bank implemented the 11th BPS in November 2020, in accordance with the adoption of IBA scales.

The employees were paid the revised salaries for the months of November and December 2020. However, due to financial trouble currently being faced by the Bank, the employees were paid reduced salaries, in accordance with the 10th BPS, in the month of January 2021.

IPPS Employees Receive Email from Bank CEO

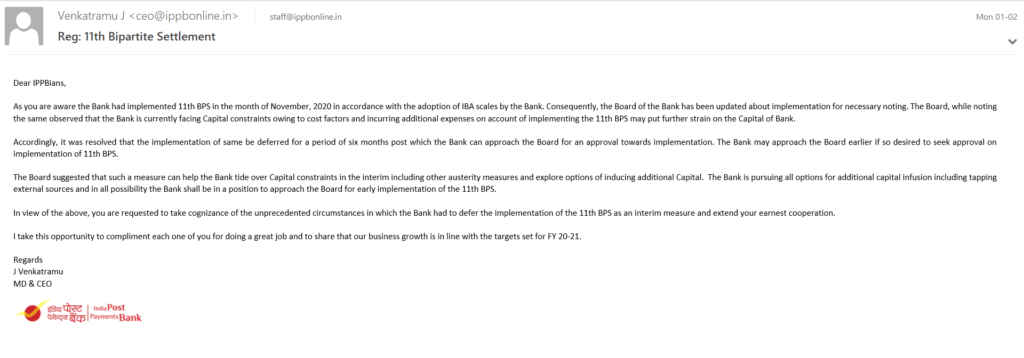

The aforementioned official also informed that this month the employees of the bank received an email from the CEO, Mr. Venkatramu, regarding a reduction in their salaries to the 10th BPS standards, resulting from the ongoing financial trouble and capital constraints undergoing by the bank.

As per the image of the email shared by the official with Trak.in, the employees were informed that the implementation of the 11th BPS pay will have to be deferred for a period of 6 months, post which the Bank will pursue the Board for approval of the same.

The email also read that as suggested by the Board, a measure of this nature would aid the Bank tide over Capital constraints in the meantime, while including other austerity measures and exploring options of including additional Capital.

IPPS Bank Employee Union File Case in Delhi HC

The India Post Payments Bank Officers Association has filed an order dated 08/02/21, against the Bank management in the Delhi High Court.

The order, a copy of which has been seen by Trak.in, has been filed by petitioners Mr.Karan Sharma, Mr.Rohit Kaliyar, Mr.Mohit Siwach and Ms.Nitya against the Bank and others, on account of being paid on the basis of 10th tripartite settlement, instead of the 11th tripartite settlement.

Attached below is a copy of the Delhi HC order.

No comments:

Post a Comment