OTHER BLOGS LINK

YOU ARE VISITOR

Blog Archive

LIVE

Sunday, January 31, 2021

LEAVE ENCASHMENT AT THE TIME OF SUPERANNUATION FULLY EXEMPTED FROM INCOME TAX

Congratulations all reader and blog viewer we reach 1cr viewer today (10000000)

Honesty is the Best Policy

People trust each other when they know they can be honest with each other. It is impossible to trust someone who is always dishonest with you about issues. Honesty is a moral value that most people in society have because they know that telling lies won’t benefit them in the long run. Honesty is the most important value to have in the workplace, for example. If you are selling a product to a customer, you want to be honest about that product and explain what it can do to benefit that customer. If you are working with bosses or other employees, you want to be honest about your performance at work and how you feel things are going in the company.

If You Break It, You Bought It

This is a moral value where customers in a store are kept in check. Also known as the Pottery Barn Rule, this is regularly used as a store policy where if a customer causes any damage to any products that are on store shelves they are automatically held responsible for the cost of that damage. This moral value teaches responsibility on the part of customers, encouraging them to be more careful when handling property that isn’t theirs. Alternatively, the phrase “if you break it, you bought it” can be used in political or military arenas where if the person in question creates a problem, he or she is obligated to do the necessary work to correct it.

100%DA Issue. Fact behind it

Saturday, January 30, 2021

BANK UN-ION SENT LETTER TO SITARAMAN OPPOSE PRIVATISATION OF PSU BANK

Friday, January 29, 2021

DA INCREASE FOR BANKER 33 SLAB FROM FEB 2021 AND NEW DA STOOD 26.18%

Today i.e. on 29.01.21 CPI for the month of Dec'20 announced with decrease of 1.10 points from Nov'20 as per base year 2016 and 3.16 points of base year 2001. Earlier Govt vide their notification dated 22.10.20 has changed the Consumer Price base year from 2001=100 to 2016=100 for Industrial Workers.

On the basis of CPI data announced by the Govt for the months of Oct'20 to Dec'20 the percentage of increase in DA is 33 slabs. In terms 11 th BPS the revised DA slabs would become payable from Feb'21 is 374 slabs i.e. total percentage of DA payable would become payable on revised pay = 26.18%.

Thursday, January 28, 2021

EVERYTHING WILL BE SOLD OUT IN COMING DAYS

The total no of complaints stood at 308630---RBI says it will charge banks if they do not improve customer grievance

At the end of March 2020, the total number of complaints across various offices of RBI stood at 3,08,630. This is a steep rise from 1,95,901 complaints outstanding at the ombudsman offices, as per data from the Trends and Progress Report of the RBI.

If a lender has higher unresolved complaints than average, it will be charged. Bank customers, however, will continue to enjoy free cost of redressal.

The central bank said on Wednesday night this was necessitated because of increasing customer grievances lodged with the banking ombudsman, which merited greater attention by banks.

Disclosures, according to the central bank, "serve as an important tool for market discipline as well as for consumer awareness and protection.”

“Appropriate disclosures relating to the number and nature of customer complaints and their redress facilitate customers and interested market participants to better differentiate among banks to take an informed decision in availing their products and services.”

To operationalize the cost-recovery framework for banks, peer groups based on the asset size of banks as on March 31 of the previous year will be identified. The central bank will consider three parameters – average number of maintainable complaints per branch, average number of maintainable complaints per 1,000 accounts held by the bank; and average number of maintainable digital complaints per 1,000 digital transactions executed through the bank by its customers.

If there is an excess of one parameter, 30 per cent of the cost will be recovered from banks. In case of excess in two parameters, 60 per cent of the cost will be recovered, and if the bank is found lacking in all three parametsrs, 100 per cent of the cost would be recovered from the bank.

ED arrests Yes Bank co-founder Rana Kapoor in fresh money laundering case

Yes Bank co-promoter Rana Kapoor was arrested by the Enforcement Directorate on Wednesday in a fresh money laundering case linked to alleged diversion of Rs 200 crore bank loan fund, official sources said.

Kapoor, 63, is lodged in a Mumbai jail since March last year after he was arrested by the central probe agency in connection with alleged financial irregularities and purported kick backs paid to him and his family members in return for certain dubious loans provided by the Yes Bank to a number of high-profile borrowers.

The Bombay High Court had recently rejected yet another bail plea of Kapoor in the Yes Bank case.

In the latest case, sources said, Kapoor was placed under arrest in prison as per provisions of the Prevention of Money Laundering Act (PMLA).

He was later produced before a special PMLA court in Mumbai that sent him to ED custody

Sources said the ED is probing the role of Kapoor, a company called Viva Group promoted by Maharashtra MLA and Bahujan Vikas Agadhi (BVA) party chief Hitendra Thakur, Housing Development Infrastructure Ltd (HDIL), its promoters Rakesh Kumar Wadhawan and his son Sarang Wadhawan for allegedly “siphoning off” a Rs 200 crore loan sanctioned by the Yes Bank to a company called Mack Star Marketing Pvt Ltd.

This fresh ED case is based on a CBI FIR filed against the accused.

“This loan was siphoned by the Wadhawans by showing it for fictitious purpose,” the ED had said in a statement issued last week after it raided the premises of Viva Group in the Vasai-Virar area of Palghar district and Mumbai.

Tuesday, January 26, 2021

No withdrawal of old series of Rs100, Rs10 and Rs5 banknotes from circulation: RBI

The Reserve Bank of India(RBI) today clarified that the central bank has no intention of withdrawing old series banknotes of Rs100, Rs10 & Rs5.

The RBI has put out a tweet from its official Twitter handle stating that" With regard to reports in certain sections of media on withdrawal of old series of ₹100, ₹10 & ₹5 banknotes from circulation in near future, it is clarified that such reports are incorrect."

The RBI introduced a new Rs100 denomination currency note as a part of the Mahatma Gandhi (new) series of banknotes, the new Rs100 prominently carries the motif of ‘Rani-Ki-Vav’ (The Queen’s Stepwell), a UNESCO World Heritage site in Gujarat.

The new ₹ 10 note in the Mahatma Gandhi series is designed in the base colour of chocolate brown and has the motif of the Konark Sun Temple in Odisha on the reverse.

Also the Press Information Bureau (PIB) conducted a fact check and debunked the reports of RBI discontinuing the old series banknotes of Rs100, Rs5 and Rs10 . “It is being claimed that hundred, ten and 5 rupee notes will no longer be legal tender from March 21, as per the information given by RBI. This claim is false", the PIB tweeted from its Twiiter handle.

Monday, January 25, 2021

Bank gives pandemic bonus of its 170,000 staff Rs 55000/- each

Bank of America is rewarding its over 1.7 lakh staff worldwide, including over 24,000 in India, with a cash award of USD 750 each to those earning under USD 1 lakh in annual compensation for the appreciation of their work through the pandemic.

Called 'delivering together' compensation awards, the bank expects over 97 per cent of its employees to get the special one-time cash bonus.

In an internal memo sent to the employees worldwide, which has been accessed by PTI, Bank of America chief executive Brian Moynihan said in appreciation for the outstanding efforts, the management team and board have decided to recognise employees with 'delivering together' compensation awards.

During the first quarter of 2021, all eligible employees with USD 1 lakh or less in annual total compensation will be paid a cash bonus of USD 750 each. Those in the US will receive this award in late February and those outside the US will receive the payment in March, Moynihan said.

He pointed out that these awards build on the shared success cash awards of USD 1,000 and related stock awards announced to employees in the fourth quarter of 2017, 2018 and 2019.

Moynihan also expects almost 97 per cent of employees who he calls as teammates will receive the delivering together award.

In addition, all eligible teammates with greater than USD 1 lakh to USD 5 lakh in annual total compensation will receive a grant of 150-750 restricted stock units, based on their compensation tier.

This stock award from March will be delivered in equal payments over four years starting 2022.

He said these awards are in addition to any regular annual incentives that eligible employees may receive.

This move is the next step our company is taking to significantly invest in health, safety, benefits and other resources to support you during this global health and humanitarian crisis, he said.

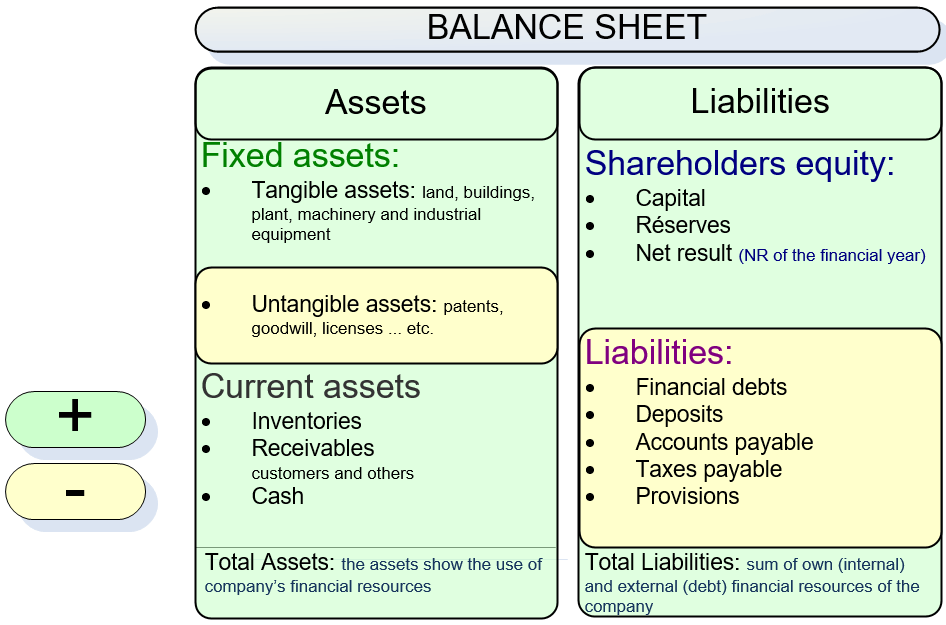

BALANCE SHEET ANALYSIS AND DIFFERENT TYPE RATIOS

- Will your customer be able to pay you at the due dates of your invoices?

- Is he solvent ?

- Does he have sufficient liquidity to honor its short-term and medium / long term debts ?

This analysis will enable you to determine it.

This analysis will enable you to determine it.Solvency Ratios

Who really owns the company ?Total liabilities / total equity: It’s showing the proportion between equities (internal financing) and debts (external financing). The more important the internal financing is, the lower is the risk of bankruptcy.

The total makes 100%. The higher % are in the high part, lower is the risk.

Shareholders Equity / (equity + liabilities) = % Bank Bank loans / (equity + liabilities) = % Creditors (including suppliers) short term liabilities / (equity + liabilities) = %

Loan ratio: Loans payable > 1 year / Equities. Shows the banking debt level. The lower it is, the less the company is financially dependent on its banks.

Should not exceed "1" in which case the banking dependence level is too high.

Liquidity ratios (ability to honor its short term debt)

Cash ratio: Accounts receivable + cash and cash equivalent - short term debts. This ratio is an excellent indicator about the capacity to refund the short term debts (thus to pay its suppliers).

>1 solvency is good. <1 The company must sell its inventories to ensure the payment of its creditors. Tensions of treasury and delays of payment can appear.

Daily Sales Outstanding (DSO): Accounts receivable / Gross revenues x 360. This indicator is showing if the accounts receivable is well or badly managed and if the company is able to be pay by its customers.

60 days if the accounts receivable are well managed (LME law in France restricts payment term up to 60 days maximum). Above 90 days is worrying especially if its customers are French (payment terms can be longer with foreigners customers).

Daily Payable Outstanding (DPO): Accounts payable / cost of goods x 360. DPO is showing the payment behaviour with suppliers. Be careful with companies having a high DPO, you may be paid with delay.

This indicator should remain below 90 days.

Inventory tunrover days: average inventory / cost of goods sold x 360 days. A ratio showing the days it takes to sell the inventory on hand.

More the result is low (< 20 days) more the company is controlling successfuly its purchasing processes and its WCR. If it is high (> 30 days), the WCR is increasing that may generate tensions of treasury. High inventory levels are unhealthy because they represent an investment with a rate of return of zero.

The financial statements falsifications

Some companies balk to publish financial statements representative of their real situation and falsify their balance sheet to post a situation in conformity with their wishes. By this way they try to:- hide financial problems which could worry their partners (customers, bankers, suppliers, shareholders etc).

- diminish the net income in order to pay less taxes or to not reveal their business margin.

In order to perform a relevant solvency analysis it is needed to detect this falsifications which can skew the assessment and the analysis which results from this.

In order to perform a relevant solvency analysis it is needed to detect this falsifications which can skew the assessment and the analysis which results from this.Real example of balance sheet falsification

Accounts receivable falsification: here is an assessment which shows seemingly a correct financial situation.

P & L K€ Assets K€ Equity & Liabilities K€ Gross revenues 12 625 Fixed assets 413 Equity 895 EBIT 516 Current assets* 5652 Liabilities 5170 Net income 265 *including accounts receivable 4983 If we look in details to the balance sheet we can see that the DSO is 144 days, which is very high.

Why ?

because this company underwent 2 unpaid for a total amount of 2 millions euros without reflecting it in their balance sheet and income statement which are in fact completely wrong.Normally, the unpaid invoice should have been written off, which impact the EBIT and the Net income which become largely negative. The loss comes in reduction from equities to -1.1 million euros. The "fair" financial statements are completely modified like below:

P & L K€ Assets K€ Equity and liabilities K€ Gross revenues 12 625 Fixed assets 413 Equity -1105 EBIT -1484 Current assets* 3652 Liabilities 5170 Net income -1735 *including accounts receivable 2983

Current assets are largely lower than the debts short terms. The company is unable to refund its debts and goes for bankruptcy (what happened a few months after the publication of the false financial statements).

Be attentive with the figures leaving the standards. A daily sales outstanding of 144 is sufficiently high to doubt on the accuracy of the accounts and to ask explanations to your customer.

Be attentive with the figures leaving the standards. A daily sales outstanding of 144 is sufficiently high to doubt on the accuracy of the accounts and to ask explanations to your customer.

Tangible Net Worth calculation and Credit analysis and Tangible Net Worth

For example, it may be stipulated in the credit management policy that the credit limit granted to customers shall not exceed xx% of tangible net worth.

Indeed, the TNW meets the obvious need, but not so easy to get, to know the intrinsic value of a company based on what is material, ie that can be converted into cash in case termination of the activity and of liquidation of assets (sale of fixed assets, inventory and payment of receivable) and the payment of debts with third parties (banks, suppliers, taxes ... etc..).

TNW is a concept very down to earth. All intangible valuations, ie intangible assets: patents, expenses, goodwill, licenses and all other intellectual property that the company may have are excluded in the calculation.

Tangible Net Worth calculation

As a key prerequisite to any assessment of TNW, it is necessary to ensure that the balance sheet is representative of the financial reality of the business. If this is not the case and financial statements are fraudulent, the TNW will be biased and lead to a false estimate of the value of the company.For example, if the value of the stock is overvalued (valuation in the balance sheet of dead stock), tangible net worth will also be false (see the pitfalls the of balance sheet). This principle is true for any difference in value of balance sheet assets (fixed assets, receivables ... etc..) compared to reality.

Why exclude intangibles from credit analysis

Intangible assets are immaterial and unquantifiable (cash is intangible but perfectly quantifiable), they are subject to subjectivity in large proportions. Indeed, how to define rationally the value of goodwill or a patent? It is extremely difficult because their actual value depends on external context which may rapidly evoluate.For example, a patent may have some value for a few months and become obsolete overnight. The value of goodwill may vary depending on many criteria: competitive environment, market growth, positioning.

Consequence of this subjectivity, the valuation of intangible assets varies with the business strategy. They will swell if the executive wants to sell his company, they will decrease if it wants to reduce its net income.

Moreover, the principle of credit analysis is to determine the capacity of a company to pay its bills in a few months. However, intangible assets are hardly marketable and therefore does not strengthen the solvency of a company in the short term.

The principle of tangible net worth is not to deny the intangible assets of a company which are, in most cases, a reality, but to put them aside because they do not help the company meet its debts .

The principle of tangible net worth is not to deny the intangible assets of a company which are, in most cases, a reality, but to put them aside because they do not help the company meet its debts .TNW calculation method

Total assets - intangible assets - total of debts to third parties

Credit analysis and Tangible Net Worth

What to do once TNW is calculated?First, the TNW is not enough to achieve a solid financial analysis. Many other factors must be taken into account when looking to the income statement and balance sheet.

However, TNW provides information about the financial base of the client. As a lender (a deferred payment granted to the client equals a credit given), we must ask ourselves the following question: how much can I loan to this company?

TNW plays a pivotal role in the answer to this question: it does not make sense to give to the customer a credit limit greater than 100% of his TNW. 80% is far too high.

Tip: Never set a credit limit exceeding 50% of the TNW, which is already very high.

Tip: Never set a credit limit exceeding 50% of the TNW, which is already very high.This percentage varies depending on cases. For example, if the customer analyzed has serious cash flow problems, it is very risky to grant him an outstanding equal to 50% of its TNW because you may become his main creditor. You won't be able to disengage and you will face an agonizing dilemma:

- Cancel or reduce the credit line, which can push the customer to bankruptcy, which will result in bad debts for the supplier,

- Continue to accompany him by accepting late payments with the risk that despite this assistance he fills for bankruptcy and thus generates very large outstanding for those who have given support.

-

Changes in leave rules for bank employees and Bank officers were updated in terms of the 12th BPS/9th Joint Note dated 08.03.2024 This post ...

-

The Government of India has approved a new transfer policy for Public Sector Bank Employees. This new policy will be applicable from 1st Apr...

-

1. Bank of Maharashtra - 15 days PLI 2. UCO Bank - 5 days PLI 3. Central Bank of India - 5 days PLI 4. Indian Bank - 10 days PLI 5. SBI...