The finance ministry, on Friday, cut interest rates for all but one of the 12 small savings schemes for the July-September quarter. This has been done in a bid to speed up the transmission of interest rates and to reduce cost of capital and enable higher lending and thus boost economic activity.

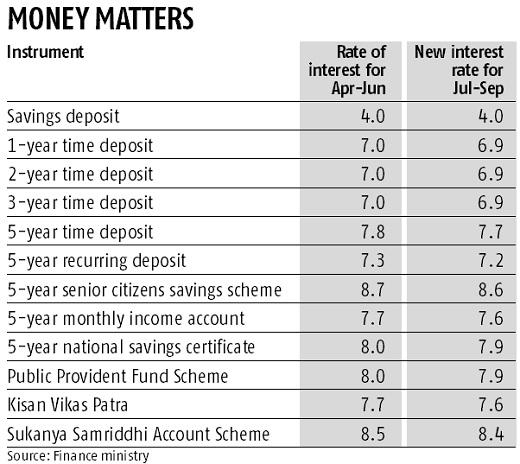

A notification on the finance ministry website on Friday showed that interest rates for all the small savings schemes, except savings deposits, were reduced by 10 basis points. The savings deposit interest rate was maintained at 4 per cent.

That the interest rates would be cut was expected. Reducing the cost of capital to boost investment has been a stated aim of the Narendra Modi administration in its second term. Part of that was done when the Reserve Bank of India’s Monetary Policy Committee (MPC) cut interest rates thrice. Now the small savings rates have been reduced to speed up the transmission of the interest rates.

In fact, the aim of lowering the cost of capital also reflected in the ruling Bharatiya Janata Party’s 2019 election manifesto. “By lowering inflation and cleaning up the banking system, we are now in a position to structurally lower the real cost of capital,” the relevant sentence in the manifesto stated.

The MPC, which is heading by RBI Governor Shaktikanta Das, had cut the policy rate by 25 basis points and changed its stance to epo rate now stands at 5.75 per cent. This is the third consecutive cut by 25 bps each since February. In all his monetary policies, the Das-led MPC has executed a cut.

Banks have been reluctant to cut their lending rates citing higher interest rates for the small savings schemes. The government hopes that the latest action will lead to banks also lowering the cost of borrowing for corporate and individual borrowers. It believes that the most effective way to boost investment for the corporate entities and consumption for the households is by reducing rates and this putting more money in their hands.

Since April 2016, the government has been setting interest rates on small savings schemes on a quarterly basis to better align them with market rates. However, small savings rates continue to be decided in an arbitrary manner with movements in government bond yields usually not reflecting in the interest rate of these schemes.

The interest rates on all small savings schemes were left unchanged for Apr-Jun due to upcoming Lok Sabha elections, despite government bond yields in the secondary market declining by 29 basis points for the same period, publicly available data on Bloomberg shows. Interest rates on small savings schemes have been tweaked in two of the last four quarters, with October-December seeing a hike of 30-40 basis points.

No comments:

Post a Comment