To link Aadhaar with PAN, the Income Tax Department has launched a new facility to complete the process quickly. The government, under the Finance Act 2017, has made it mandatory for taxpayers to quote Aadhaar or enrolment ID of Aadhaar application form for filing income tax returns (ITR). Also, Aadhaar has been made mandatory for applying for PAN or permanent account number with effect from July 1, 2017. "Taxpayers are requested to use the simplified process to complete the linking of Aadhaar with PAN immediately. This will be useful for E-Verification of Income Tax returns using OTP sent to their mobile registered with Aadhaar," the Income Tax Department said in an email to taxpayers.

Here's the process to link Aadhaar with PAN in 10 steps:

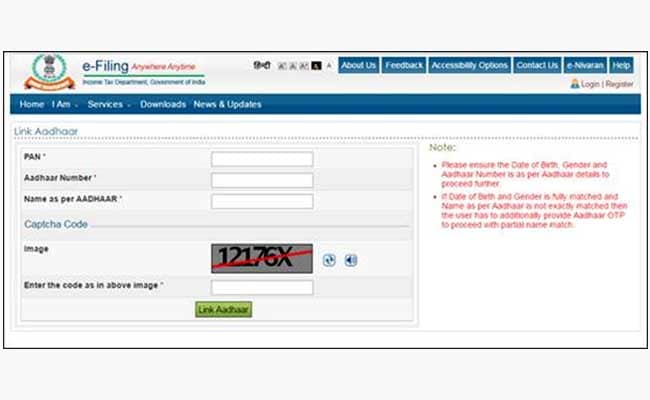

1) The income tax department's e-filing website - incometaxindiaefiling.gov.in - has a new link on its homepage for connecting Aadhaar with PAN of a taxpayer.

2) There is no need to log in or be registered on e-filing website of the income tax department. This facility can be used by anyone to link their Aadhaar with PAN.

2) There is no need to log in or be registered on e-filing website of the income tax department. This facility can be used by anyone to link their Aadhaar with PAN.

3) The link requires a person to key in his or her PAN number, Aadhaar number and the "exact" name as mentioned on the Aadhaar card.

4) After verification from the UIDAI (Unique Identification Authority of India), the linking will be confirmed. "In case of any minor mismatch in Aadhaar name provided, Aadhaar OTP (one-time password) will be required," the income department said in its advisory to taxpayers.

4) After verification from the UIDAI (Unique Identification Authority of India), the linking will be confirmed. "In case of any minor mismatch in Aadhaar name provided, Aadhaar OTP (one-time password) will be required," the income department said in its advisory to taxpayers.

5) The OTP will be sent on the registered mobile number of the individual as provided in the Aadhaar database.

6) The Income Tax Department has urged taxpayers to ensure that details like date of birth and gender in PAN and Aadhaar are exactly the same, to ensure linking without failure. (Also read: Aadhaar-enabled payments double)

7) In rare cases where the name mentioned on the Aadhaar card is completely different from that on PAN, the linking attempt will fail and the taxpayer will be prompted to change the name in either of the two databases, the tax department said.

8) The tax department introduced the new simplified system after receiving complaints that taxpayers who had used initials in one and full name in the other were not able to link the two unique identities.

9) The tax department also said that the facility to link Aadhaar is also available after logging into the e-filing website under the Profile.

10) Till now over 1.18 crore Aadhaar numbers have been linked with PAN database, a report by news agency Press Trust of India said.

Here's the process to link Aadhaar with PAN in 10 steps:

1) The income tax department's e-filing website - incometaxindiaefiling.gov.in - has a new link on its homepage for connecting Aadhaar with PAN of a taxpayer.

3) The link requires a person to key in his or her PAN number, Aadhaar number and the "exact" name as mentioned on the Aadhaar card.

5) The OTP will be sent on the registered mobile number of the individual as provided in the Aadhaar database.

6) The Income Tax Department has urged taxpayers to ensure that details like date of birth and gender in PAN and Aadhaar are exactly the same, to ensure linking without failure. (Also read: Aadhaar-enabled payments double)

7) In rare cases where the name mentioned on the Aadhaar card is completely different from that on PAN, the linking attempt will fail and the taxpayer will be prompted to change the name in either of the two databases, the tax department said.

8) The tax department introduced the new simplified system after receiving complaints that taxpayers who had used initials in one and full name in the other were not able to link the two unique identities.

9) The tax department also said that the facility to link Aadhaar is also available after logging into the e-filing website under the Profile.

10) Till now over 1.18 crore Aadhaar numbers have been linked with PAN database, a report by news agency Press Trust of India said.

No comments:

Post a Comment