- Rs 16,000 crore was not deposited back to the banks in the Demonetisation,2016.

the Reserve Bank of India (RBI) today said out of the Rs 15.44 lakh crore of notes taken out of circulation, Rs 15.28 lakh crore was returned to the system by way of deposits by the public. - This means that 0.16 lakh crore or Rs 16,000 crore was not deposited back to the banks in Demonetisatio.

- According to demonetisation figures released by the central bank, 8.9 crore old Rs 1,000 notes out of 632.6 crore is yet to be returned after demonetisation.

In percentage terms, it is 1.4 percent of the now-defunct Rs 1,000 notes which is missing from the banking system. - The government had banned old Rs 500 and Rs 1,000 notes in an attempt to weed out black money in the country in the November-2016. RBI said there were as many 588.2 crore of Rs 500 notes, both old and new in circulation as of March 31, 2017. As of March 31, 2016, there were 1,570.7 crore Rs 500 notes in circulation.

- The report further said that the cost of printing of currency notes more than doubled to Rs 7,965 crore in 2016-17 from Rs 3,421 crore in the previous year on account of new currency printing.

- It detected 199 counterfeit notes of the new Rs 500 denomination and 638 of Rs 2000 notes. But these were a minuscule proportion of the 762,072 fake note pieces detected during that year, an increase compared to 632,926 pieces a year ago.

Besides, new Rs 500 and Rs 2000 notes, the RBI has also printed new Rs 200 notes.

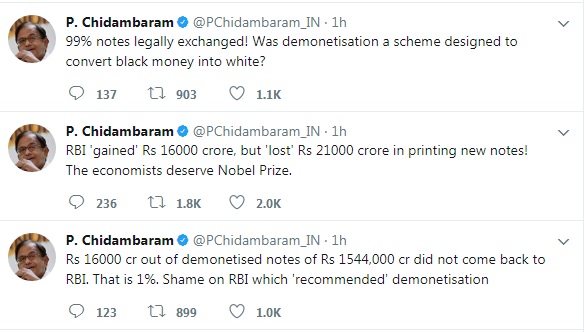

Former Finance Minister P Chidambaram said the central bank lost Rs 21000 crore in printing new notes.

No comments:

Post a Comment