After Vaani, a 29-year-old woman who quit her government bank job, another government bank employee has now resigned, raising serious allegations of a toxic work culture prevailing in public sector banks

A government bank employee, who had been working for 15 years, has decided to quit his job. He said that his decision was not sudden, but the result of health problems, growing work pressure, and the loss of personal peace of mind

He shared his story on the popular Reddit community r/IndianWorkplace, where many professionals discuss their work-life experiences. His post quickly caught attention because it challenged the common belief that a government banking job is always “safe and prestigious”.

Feeling Trapped in a ‘Dream Job’

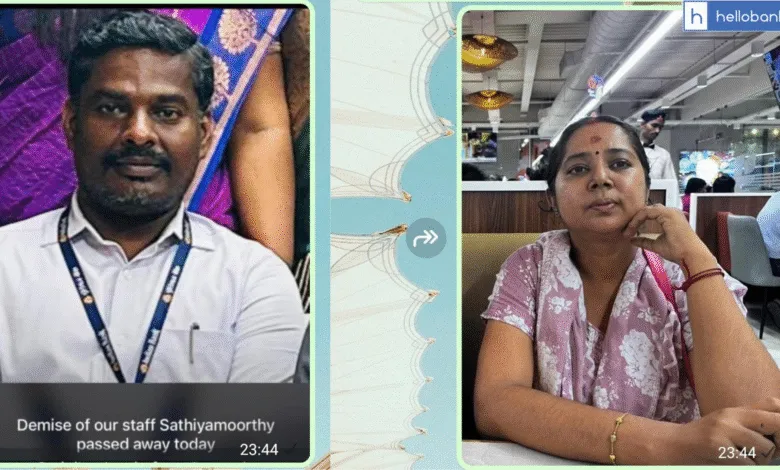

In his post, the 39-year-old employee wrote, “At 39, I feel suffocated in my government bank job. I don’t think I can do it anymore.” He also uploaded a picture of his office to show the reality of his workplace.

The photo seems to be of Indian Bank. This means that the person was working in branch of Indian Bank – one of the public sector banks in India.

The banker recalled how he once saw the job as a dream come true. He had cleared three rounds of tough, all-India level exams to secure this position. Like many others, he believed a Public Sector Undertaking (PSU) bank job would bring him stability, a good salary, a house, a car, and respect in society.

But over the years, things changed. The dream of stability turned into a life of stress and poor health.

Health Issues and Long Work Hours

The employee revealed that his work life had taken a serious toll on his health. He is now suffering from high blood pressure, thyroid problems, and fatty liver disease. According to him, this happened because of:

- Transfers to far-off and remote places

- Strict sales targets that were almost impossible to meet

- Extremely long working hours, often stretching from 10 am to 10 pm

- Weekend work with no real time to rest (Work on Sundays)

Adding to his frustration, he said he was being forced to sell what he described as “useless insurance products” to customers. He felt this went against the true purpose of banking.

No Space to Raise Concerns

The banker also pointed out that employees were discouraged from raising their voices or sharing problems publicly, even on social media. He wrote that many of his colleagues were also reaching their breaking point, but were afraid to speak out.

In his own words: “I no longer feel like I can do justice to myself.”

A Bold Decision to Quit

Finally, he took the drastic step of simply stopping work. He admitted that he is still technically in service, but he has chosen not to report to duty anymore.

He concluded his Reddit post by writing: “Yes, this means my salary will stop. My financial struggles may begin. But I hope, with all my heart, that I’ll get my life back.